Blog

Our Blog is designed to keep you up to date with developments of Spanish law and news.

You will also find some of our Top Tips for different areas of law to give you some key advice when requiring legal services in Spain. If you cannot find what you are looking for or would like to discuss a matter further, please contact us.

Income Tax Return in Spain for Expats: What You Need to Know

If you are a tax resident in Spain, it is important to understand your tax obligations, especially regarding the Income Tax Return. Failing to comply with this obligation can lead to unnecessary penalties and surcharges. We explain the key aspects you need to consider to comply with current regulations and avoid issues with the Tax Agency.

What is a Digital Certificate in Spain?

The Digital Certificate is an electronic tool that allows secure identification of an individual or company in the digital environment.

A Digital Certificate is essential for securely carrying out online transactions with the Spanish administration. Whether you need to sign documents electronically, or access government services, a digital certificate ensures your identity is verified and your transactions remain secure.

A Guide to US Notary & Apostille Services for US Citizens Moving to Spain

If you’re a US citizen looking to buy property in Spain, apply for residency, or manage legal affairs, you’ll likely need notarised and apostilled documents. But what does that mean? We spoke with Amber Nicole Hess, a California-based notary and apostille agent, to break it down for you.

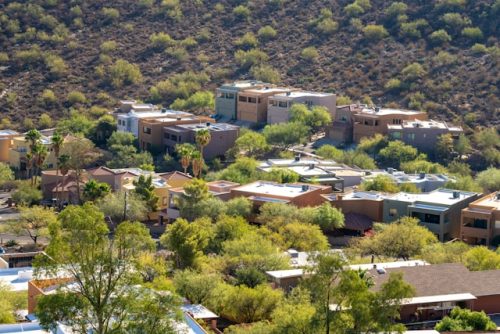

Buying Property in Almería: Why This Spanish Region is a Hidden Gem

Are you thinking about buying a home in Spain? Almería is a fantastic choice, offering beautiful beaches, authentic Spanish culture, and great property prices compared to Costa del Sol and Costa Blanca. We spoke with Cecilia from Grupo Platinum to get expert insights into the property market and what makes Almería a top destination for home buyers.

Spain’s Proposed Tax for Non-European Property Buyers: What You Need to Know

Spain’s Prime Minister Pedro Sánchez recently announced a proposal that has created concern in the Spanish real estate market—a 100% tax on property purchases for non-European buyers. But is this law actually going to pass? What could the tax be? And what does it mean for those looking to buy property in Spain?

Possible Property Ownership Tax changes in Spain

On Monday 13 January Pedro Sánchez, Spain’s Prime Minister, announced a raft of measures targeting non-EU citizens who are not resident in Spain. These include imposing a tax on real estate purchases to effectively restrict non-residents from buying a property in Spain.

Communities of Owners and Tourist Rentals in Spain

Recent legal updates have significantly strengthened the ability of Communities of Owners to regulate or limit tourist rentals. The Organic Law 1/2025 of 2nd January, introduces important changes to the Horizontal Property Law (Law 49/1960).

Ten Years in Review

10 years ago I left the comfort of a salaried job to launch My Lawyer in Spain. A new and innovative law firm focused on international clients buying, selling and inheriting property. We decided to offer all types of support including assisting with tax returns for all nationalities moving to and doing business in Spain. Our mission and focus would be on client care and offer excellent practical legal advice for foreigners new to Spain.

Your Guide to Buying Land and Building a Property in Spain

With housing being at a shortage in 2024, it could be time for you to find your perfect home in Spain by building. Buying land and constructing a property can be a rewarding journey, but it requires careful planning and expert advice. In this guide, Alex and John Wolfendale of Eco Vida Homes share practical tips on navigating the Spanish property market, from choosing the right plot to managing costs and complying with building regulations.

Buying Off-Plan Property in Spain: Everything You Need to Know

Purchasing an off-plan property in Spain can be an exciting investment opportunity, especially with the limited stock in the resale market. However, it requires careful planning and due diligence to ensure a smooth process. In this blog, we’ll explore the main considerations for buying off-plan property, including costs, legal obligations and tips for protecting your investment.