Explained – Personal Tax in Spain

Join Alex Radford and Pedro San Nicolás González as they explain personal tax in Spain for Spanish Tax Residents.

Learn:-

- What taxes do I as a person pay in Spain as a Spanish tax resident?

- When are these paid?

- How are they calculated?

- Is there an amount I can earn without paying tax?

- Even if I have no income, do I still have to submit a tax declaration?

- How much tax do I have to pay on a private or Government pension?

- Do I pay tax on the income from the Spanish property I rent out?

- Do I pay more tax in the UK or in Spain? What taxes do I as a person pay in Spain as a Spanish tax resident?

(topics covers also shared below)

What taxes do I as a person pay in Spain as a Spanish tax resident?

The tax which all individuals who are tax residents in Spain are obliged to pay, regardless of their nationality or origin, is Spanish income tax (Income Tax). This taxes the income obtained by physical persons during the calendar year, that is, between January 1 and December 31.

What is considered income for spanish tax purposes?

The main ones are income from work (including pensions), in the case of the self-employed, income from their economic activity, capital gains, interest or benefits obtained through financial products, and dividends derived from the possession of shares companies.

When are these paid?

The income tax declaration is filed annually, between the first week of April and June 30. During this period, the income obtained in the previous year must be declared. For example, this year it is between between April 6 and June 30, 2023, we should declare what we have obtained in 2022.

How are these taxes calculated?

The answer is not that simple as it depends on the personal and family conditions of each person, and on the income that is declared.

Each person has a minimum for which they do not declare (5,550 euros in 2021), and depending on the age of the taxpayer, that limit is increased. Also, depending on the number of relatives who live with the taxpayer, this minimum could increase, if they meet some other requirements.

There are more special minimums, for example in the case of family members who live with the taxpayer who have some type of disability.

There are also special deductions, for example for the payment of the rent of the habitual residence. It is highly recommended to consult with a tax advisor as to which deductions you may be entitled to .

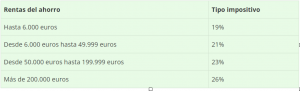

Once the income has been reduced with the tax minimums and the reductions, we must apply a tax scale. Depending on the amount, a tax rate will be applied:

For example, if we have net income €25,000, a tax rate of 30% will be applied.

Is there an amount I can earn without paying tax?

YES. Income from a single company and if you earn less than 22,000 euros, no need to submit a tax return.

Self employed person earning up to 14,000 euros from various payers, does not have to submit tax return.

Rentals and capital gains of up to 1.600 € anuales.

If I do not rent my property for more than 1.000 €.

Even if I have no income, do I still have to submit a tax declaration?

There are cases in which it may be necessary to make the declaration even if no income has been obtained, for example, if you have various properties and the SELF CALLED imputed PROPERTY income is greater than €1,000.

The imputed property income depends on the cadastral value of your property:

1.1% if the value of your has been reviewed by the Spanish authorities in the last 10 years and 2% in the rest of cases.

I am a retired School teacher from England living in the UK. I pay 20% tax in the UK. How much tax would I have to pay in Spain?

As said it would depend on the income you have earned.

Lets say you have earned 32.000 € In the UK you would pay 20% and in Spain you would pay 30%. However as we have explained it is not that simple and good Spanish tax advice is recommended.

Do I pay tax on the income from the Spanish property I rent out?

Yes, they are considered as a property profit and they need to be declared in your annual income tax.

When is this paid?

This profit is declared in your annual income tax. Therefore you will need to pay it between the first week of April and 30th of June.

How much is it?

It depends on the amount that you are going to declare:

Do I pay more tax in the UK or in Spain? Can you calculate this for me?

Yes, we will be happy to calculate an estimation of what you would in Spain so you can compare with what you are currently paying in the Uk.

As said, it is not a matter of comparing the tax rates between both countries as there are many factors we need to take into account, as your family and personal circumstances.

If you need help with your personal tax affairs contact Pedro San Nicolás González at enquiries@mylawyerinspain.com.